ETAC

Carlyle European Tactical Private Credit ELTIF

About ETAC

Carlyle European Tactical Private Credit ELTIF (“ETAC”) is a European credit fund structured as an open ended, semi-liquid fund offering monthly subscriptions and quarterly redemptions. ETAC leverages Carlyle’s $194 billion Global Credit platform and seeks to provide current income and broad access to the European credit markets by strategically allocating capital across the credit spectrum. Under normal circumstances, the Fund will target investing at least 80% of its assets in private fixed income securities and credit instruments, primarily in senior secured and floating rate debt.

We believe private credit is a fundamental constituent within a well-diversified portfolio and can provide investors enhanced yields through market cycles. In launching this European private credit strategy for individuals, we are providing highly differentiated opportunities to an increasingly important investor base, enabling them to benefit from Carlyle Global Credit’s breadth of capabilities, scale of capital and its integrated global platform.

|

Taj Sidhu Head of European and Asian Private Credit |

Key Fund Facts

June 2018Fund Inception |

$2,029MM1Managed Assets |

8.65% / 7.84%2Annualized Distribution Rate |

1 Total AUM as of 9/30/22 represents managed assets including leverage (net assets of $1,328mm). Past performance does not guarantee future results.

2 As of 9/30/22 based on I share class. Represents income, capital gains and return of capital (if any) in the stated reporting period. Annualized distribution rate is calculated by taking the stated quarter’s distribution rate divided by the quarter-end NAV and annualizing, without compounding. Last Twelve Months “LTM” distribution rate is calculated by taking the total distribution rate over the period divided by the current quarter-end NAV.

3 Duration (Years) on Assets: Duration measures interest rate sensitivity; the longer the duration, the greater the volatility as rates change.

4 Level of Debt and Preferred Equity as a Percent of Total Assets.

Performance

11.80%Total Return Year-to-Date |

11.80%Total Returns since Inception (03 Jan 2023) |

$224.0MNet Asset Value |

$11.18Net Asset Value Per Share |

Performance of I shares as of August 31, 2023.

Past performance is not a guarantee of future returns. Returns shown net of all fees and expenses. The Fund pays a monthly management fee equal to 1.25% on an annualized basis of the Fund’s net asset value. The total expense ratio is 3.25%.

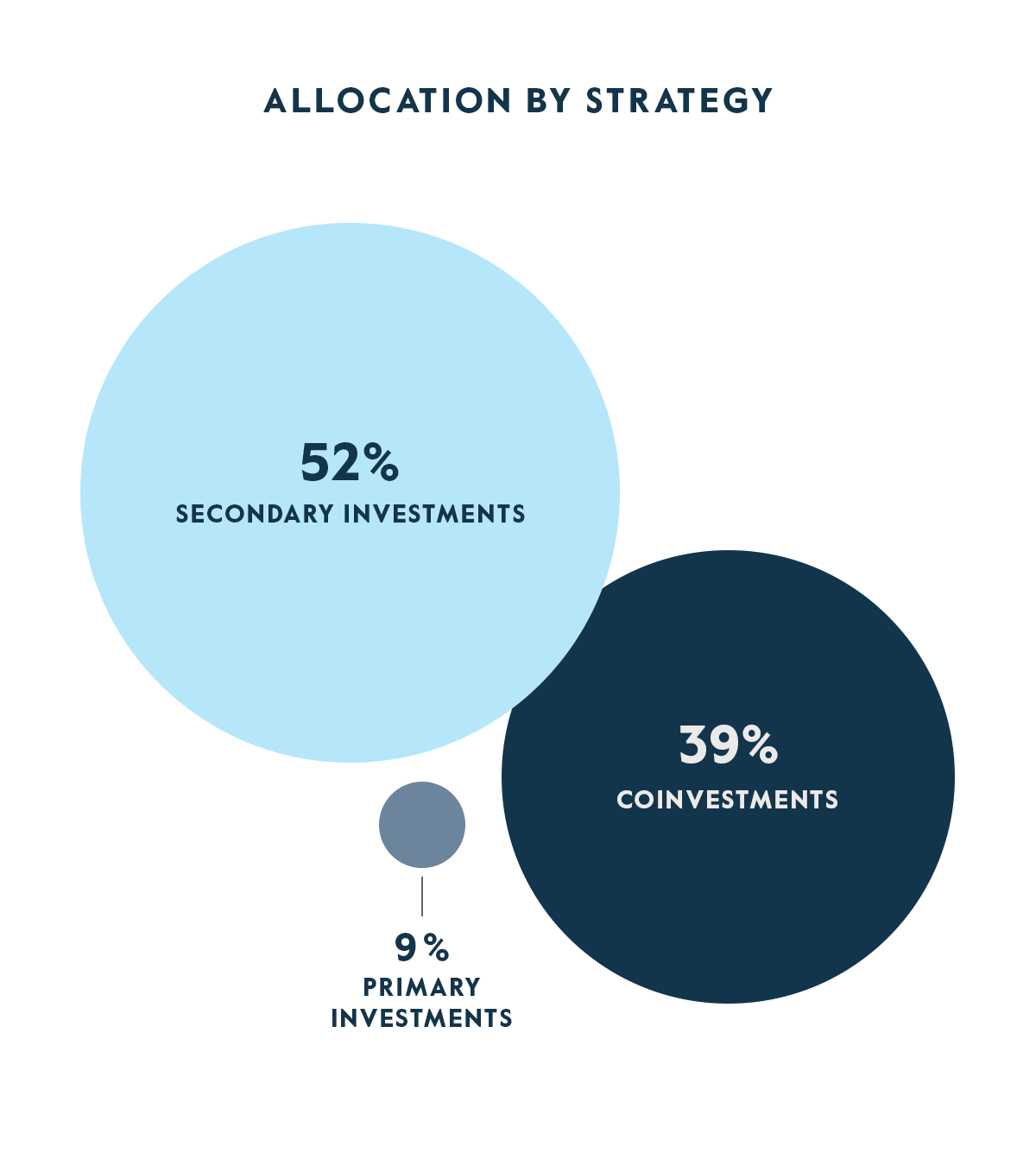

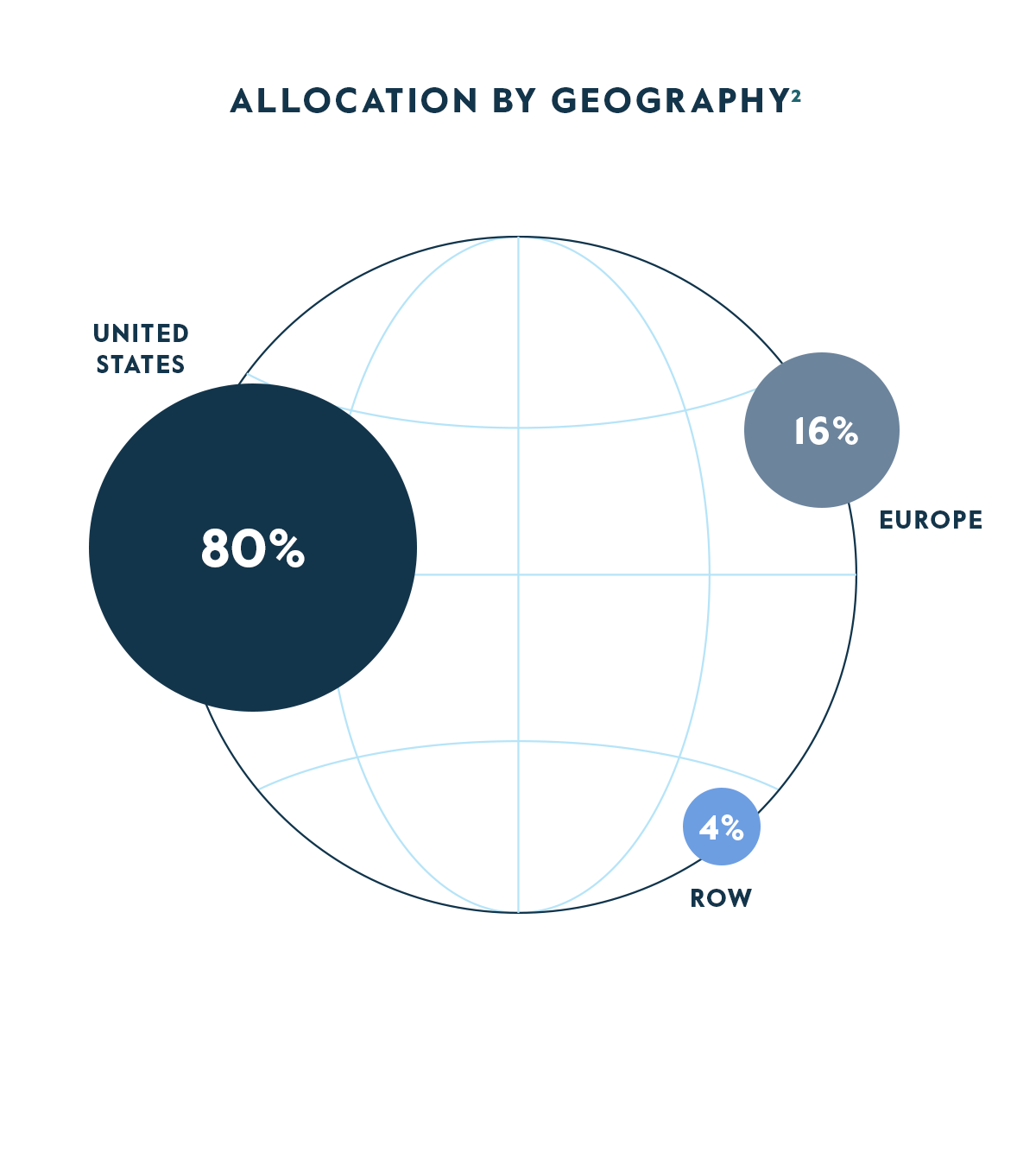

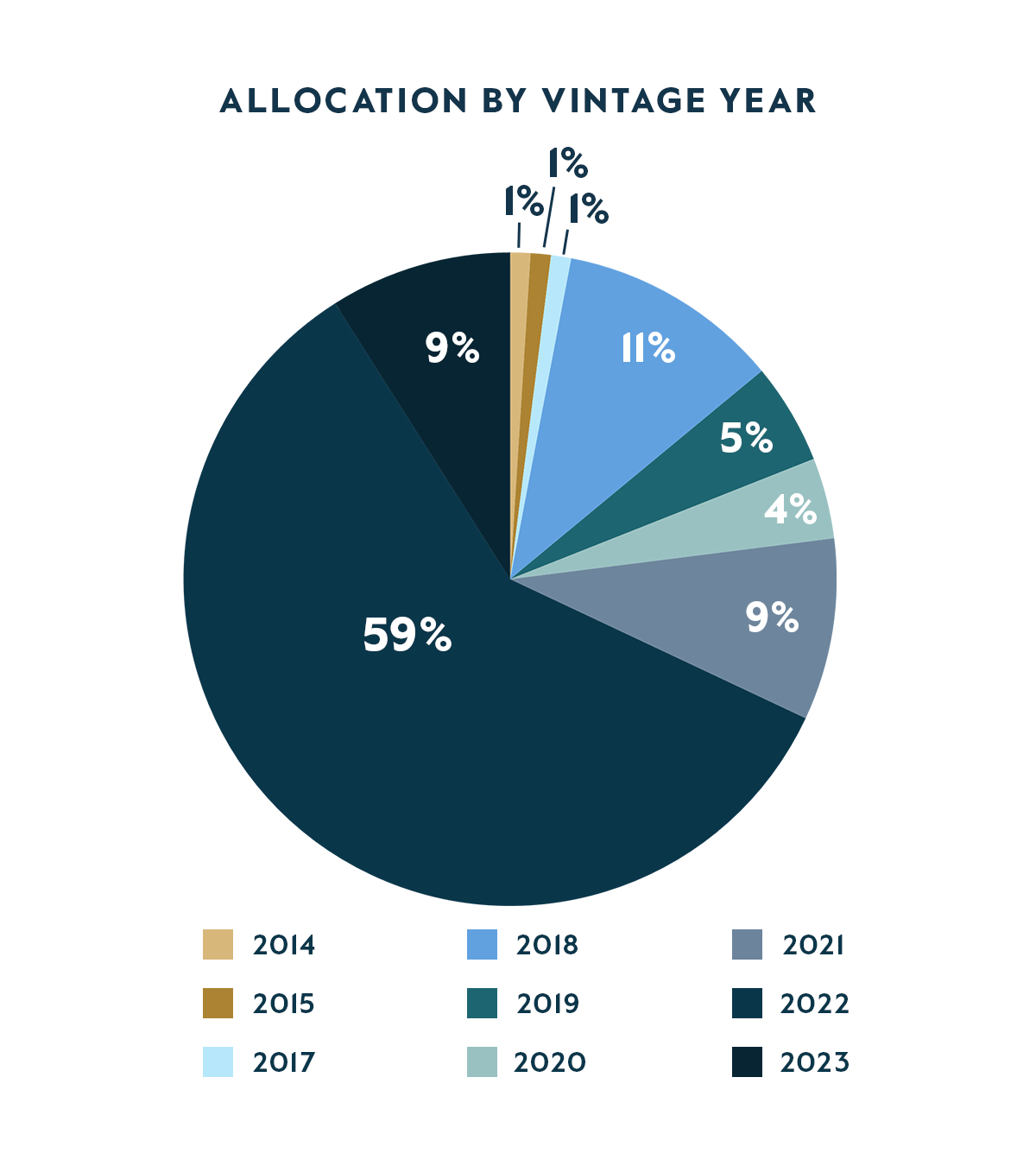

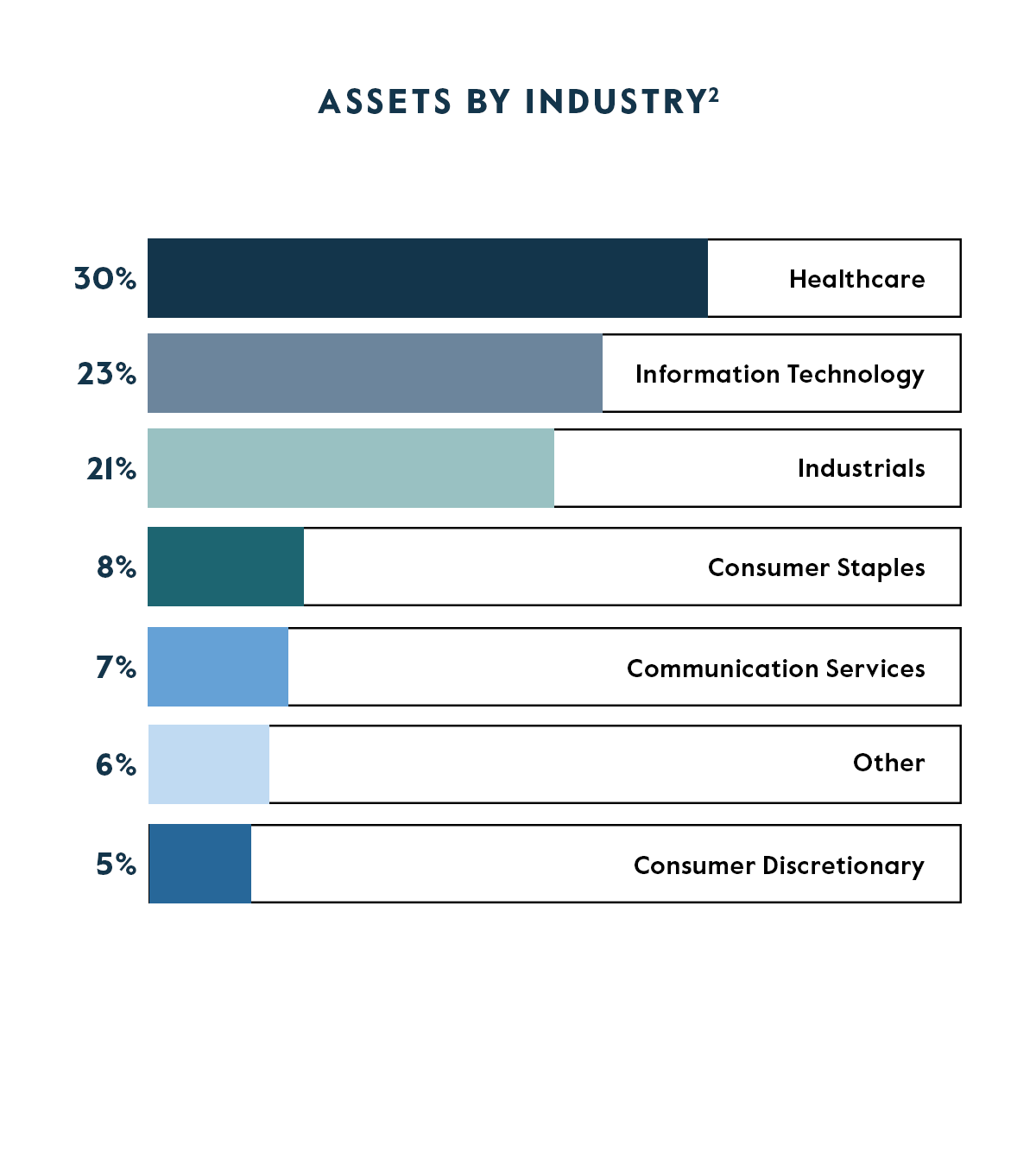

AlpInvest Portfolio Details

As of August 31, 2023.

Materials

Key Investor Documents (KIDs)

| Class | Currency | Type of Share |

| Class A – Danish | EUR | Distributing |

| Class A1 – Danish | EUR | Accumulating |

| Class C – Danish | EUR | Distributing |

| Class I – Danish | EUR | Distributing |

| Class I1 – Danish | EUR | Accumulating |

| Class M – Danish | EUR | Distributing |

| Class M (Italy) – Danish | EUR | Distributing |

| Class M1 – Danish | EUR | Accumulating |

| Class M1 (Italy) – Danish | EUR | Accumulating |

| Class | Currency | Type of Share |

| Class A – Dutch | EUR | Distributing |

| Class A1 – Dutch | EUR | Accumulating |

| Class C – Dutch | EUR | Distributing |

| Class I – Dutch | EUR | Distributing |

| Class I1 – Dutch | EUR | Accumulating |

| Class M – Dutch | EUR | Distributing |

| Class M (Italy) – Dutch | EUR | Distributing |

| Class M1 – Dutch | EUR | Accumulating |

| Class M1 (Italy) – Dutch | EUR | Accumulating |

/media/9786

| Class | Currency | Type of Share |

| Class A – English | EUR | Distributing |

| Class A1 – English | EUR | Accumulating |

| Class C – English | EUR | Distributing |

| Class I – English | EUR | Distributing |

| Class I1 – English | EUR | Accumulating |

| Class M – English | EUR | Distributing |

| Class M (Italy) – English | EUR | Distributing |

| Class M1 – English | EUR | Accumulating |

| Class M1 (Italy) – English | EUR | Accumulating |

| Class | Currency | Type of Share |

| Class A – French | EUR | Distributing |

| Class A1 – French | EUR | Accumulating |

| Class C – French | EUR | Distributing |

| Class I – French | EUR | Distributing |

| Class I1 – French | EUR | Accumulating |

| Class M – French | EUR | Distributing |

| Class M (Italy) – French | EUR | Distributing |

| Class M1 – French | EUR | Accumulating |

| Class M1 (Italy) – French | EUR | Accumulating |

| Class | Currency | Type of Share |

| Class A – German | EUR | Distributing |

| Class A1 – German | EUR | Accumulating |

| Class C – German | EUR | Distributing |

| Class I – German | EUR | Distributing |

| Class I1 – German | EUR | Accumulating |

| Class M – German | EUR | Distributing |

| Class M (Italy) – German | EUR | Distributing |

| Class M1 – German | EUR | Accumulating |

| Class M1 (Italy) – German | EUR | Accumulating |

| Class | Currency | Type of Share |

| Class A – Italian | EUR | Distributing |

| Class A1 – Italian | EUR | Accumulating |

| Class C – Italian | EUR | Distributing |

| Class I – Italian | EUR | Distributing |

| Class I1 – Italian | EUR | Accumulating |

| Class M – Italian | EUR | Distributing |

| Class M (Italy) – Italian | EUR | Distributing |

| Class M1 – Italian | EUR | Accumulating |

| Class M1 (Italy) – Italian | EUR | Accumulating |

| Class | Currency | Type of Share |

| Class A – Spanish | EUR | Distributing |

| Class A1 – Spanish | EUR | Accumulating |

| Class C – Spanish | EUR | Distributing |

| Class I – Spanish | EUR | Distributing |

| Class I1 – Spanish | EUR | Accumulating |

| Class M – Spanish | EUR | Distributing |

| Class M (Italy) – Spanish | EUR | Distributing |

| Class M1 – Spanish | EUR | Accumulating |

| Class M1 (Italy) – Spanish | EUR | Accumulating |

| Class | Currency | Type of Share |

| Class A – Swedish | EUR | Distributing |

| Class A1 – Swedish | EUR | Accumulating |

| Class C – Swedish | EUR | Distributing |

| Class I – Swedish | EUR | Distributing |

| Class I1 – Swedish | EUR | Accumulating |

| Class M – Swedish | EUR | Distributing |

| Class M (Italy) – Swedish | EUR | Distributing |

| Class M1 – Swedish | EUR | Accumulating |

| Class M1 (Italy) – Swedish | EUR | Accumulating |

Contact Us

For additional information, please reach out to:

Americas: Global.Wealth@carlyle.com

EMEA: CGWEurope@carlyle.com

APAC: CGWAsia@carlyle.com

Summary of Key Risk Factors

Prospective investors should be aware that an investment in Carlyle European Tactical Private Credit ELTIF (the "Fund") involves a high degree of risk, and it is suitable only for those investors who have the financial sophistication and expertise to evaluate the merits and risks of an investment in the Fund and for which the Fund does not represent a complete investment program. An investment in the Fund involves subscribing to shares of the Fund and not of a given underlying asset. An investment in the Fund should only be considered by persons who can afford a loss of their entire investment. Prospective investors are urged to conduct their own due diligence on the interests in the Fund and consult with their own financial, tax, and legal advisors about the implications of investing in the Fund. The following is a summary of the principal risks of investing in the Fund and is qualified in its entirety by the more detailed risk factors sections in the Prospectus and the risks set forth in the key information document of the relevant share class. Capitalized terms not otherwise defined herein are as defined in the Prospectus.

Liquidity Risks. The Fund is designed primarily for long-term investors. An investor should not invest in the Fund if the investor needs a liquid investment. Although the Fund, as a fundamental policy, will make quarterly offers to redeem up to the lower of (1) 5% of its outstanding Shares at NAV (less costs), and (2) any limit prescribed in the regulatory technical standards adopted by the European Commission pursuant to the ELTIF Regulation as at the relevant Redemption Day, the number of Shares in respect of which an application to redeem is made may exceed the number of Shares the Fund has offered to redeem, in which case not all of your Shares tendered will be redeemed. In exceptional circumstances and not on a systematic basis, quarterly redemptions may be suspended as described in the Prospectus. Hence, you may not be able to redeem your Shares when and/or in the amount that you apply for from time to time. There is no current public trading market or secondary market for the Shares, and it is not expected that such a market will ever develop. Therefore, redemption of Shares by the Fund will likely be the only way to dispose of their Shares. The vast majority of the Fund’s assets are expected to consist of investments that cannot generally be readily liquidated without impacting the Fund’s ability to realize full value upon their disposition. Therefore, the Fund may not always have a sufficient amount of cash to immediately satisfy redemption requests, and your ability to have Shares redeemed by the Fund may be limited.

PRIIPS Risk Indicator: Under the packaged retail and insurance-based investment products (PRIIPs) Regulation, we have classified this product as 3 out of 7, which is a medium-low risk class. This rates the potential losses from future performance at a medium-low level, and poor market conditions are unlikely to impact the capacity of the Fund to pay you. Be aware of currency risk. You may receive payments in a different currency, so the final return you will get depend on the exchange rate between the two currencies. This risk is not considered in the indicator shown above. The summary risk indicator does not include all risks inherent in the Shares and therefore it does not represent the total risk to the investor. The Fund may invest in assets which have valuation and performance uncertainties and liquidity risk. The Prospectus gives more detail on the risks investors should consider. This product does not include any protection from future market performance, so you could lose some or all of your investment. If we are not able to pay you what is owed, you could lose your entire investment.

Certain Definitions. Unless otherwise indicated, all internal rates of return ("IRRs"), multiples of invested capital ("MOICs") and dividend yields are presented on a "gross" basis, i.e., they do not reflect any carried interest, management fees, taxes, transaction costs and other expenses ("Fees & Expenses") to be borne by certain and/or all investors, which will reduce returns and, in the aggregate, are expected to be substantial. Any "net" performance information is after deduction for such Fees & Expenses. An investment is considered realized when the investment fund has completely exited, and ceases to own an interest in, the investment.

An investment is considered partially realized when the total proceeds received in respect of such investment, including dividends, interest or other distributions and/or return of capital represents at least 50% of invested capital and such investment is not yet fully realized. For a description of such Fees & Expenses, please see the Prospectus and Part II of Form ADV maintained by Carlyle's registered investment advisor, Carlyle Global Credit Investment Management L.L.C., a copy of which will be furnished to each investor prior to its admission to a Fund. Prospective investors, upon request, may obtain a hypothetical illustration of the effect of such Fees & Expenses on returns.

Unregistered Status. The Shares have not been registered under the U.S. Securities Act of 1933, as amended (the "Securities Act"), the securities laws of any other state or the securities laws of any other jurisdiction, nor is such registration contemplated. The Shares will not be offered and sold in the United States under the exemption provided by Section 4(2) of the Securities Act and Regulation D promulgated thereunder. The Shares will be offered outside the United States in reliance upon the exemption from registration provided by Regulation D or Regulation S promulgated under the Securities Act and other exemptions of similar import in the laws of the states and jurisdictions where the offering will be made.

Case Studies: Case studies are presented for illustrative purposes only and are intended to provide examples of the types of transactions Carlyle pursues and do not represent all investments made by Carlyle or the outcomes achieved. Investment rationales and other considerations are based on Carlyle’s internal analysis and views as of the date of the investment commitment and will not be updated. References to a particular investment should not be considered a recommendation of any security or investment. There can be no assurance that Carlyle will be able to invest in similar opportunities in the future or that the investment shown is or will be successful.

Credit Risk: One of the fundamental risks associated with the Fund’s investments is credit risk, which is the risk that an issuer will be unable to make principal and interest payments on its outstanding debt obligations when due. The Fund may invest in loans, either through primary issuances or in secondary transactions, including potentially on a synthetic basis. The value of the Fund’s loans may be detrimentally affected to the extent a borrower defaults on its obligations. There can be no assurance that the value assigned by the Fund to collateralize an underlying loan can be realized upon liquidation, nor can there be any assurance that any such collateral will retain its value. The portfolio may include unsecured loans. Unsecured loans are subject to the same investment risks generally applicable to loans described above but are subject to additional risk that the assets and cash flow of the related obligor may be insufficient to repay the scheduled payments to the lender after giving effect to any secured obligations of the obligor. The Fund’s distressed investments (e.g., investments in defaulted, out-of-favor or distressed bank loans and debt and equity securities) are inherently speculative and are subject to a high degree of risk. The Fund’s investments are expected to include investments in issuers whose capital structures have significant leverage (including substantial leverage senior to the Fund’s investments), a considerable portion of which may be at floating interest rates. The leveraged capital structure of such issuers will increase their exposure to adverse economic factors such as rising interest rates, downturns in the economy or further deteriorations in the financial condition of the issuer or its industry.

Investment risks in general. The Fund's investments may involve highly speculative investment techniques, highly concentrated portfolios, control and non-control positions and/or illiquid investments. Investors will not have an opportunity to evaluate specific assets prior to investing in the Fund. There can be no assurance that (i) the Fund will have any profits, (ii) cash will be available for distributions, (iii) the income of the Fund will exceed its expenses, (iv) the Net Asset Value of the Fund will increase, and (v) investors will not sustain a total loss of their investment in the Fund.

Highly Competitive Market for Investment Opportunities. The activity of identifying, managing, monitoring, completing and realizing attractive investments is highly competitive and involves a high degree of uncertainty. The Fund expects to encounter competition from other entities having similar or overlapping investment objectives and others pursuing the same or similar opportunities.

Leverage. The Fund may incur permanent, Fund-level leverage including through, but not limited to, bridge, subscription, asset- backed facilities, financing transactions from prime brokers or custodians, short-sales and/or related to the Fund's hedging activities. Borrowings by the Fund will further diminish returns (or increase losses on capital) to the extent overall returns are less than the Fund's cost of funds. Such debt exposes the Fund to refinancing, recourse and other risks. As a general matter, the presence of leverage can accelerate losses. Incurrence of indebtedness at the level of the Fund (or entity through which it invests) may, among others, have the following consequences to Shareholders, including, but not limited to: (i) greater fluctuations in the NAV of the Fund's assets; (ii) use of cash flow for debt service, distributions, or other purposes (and prospective investors should specifically note in this regard that, for the avoidance of doubt, in connection with one or more credit facilities entered into by the Fund, distributions to Shareholders may be subordinated to payments required in connection with any indebtedness contemplated thereby); and (iii) in certain circumstances, the Fund may be required to dispose of investments at a loss or otherwise on unattractive terms in order to service its debt obligations or meet its debt covenants. There can be no assurance that the Fund will have sufficient cash flow to meet its debt service obligations. As a result, the Fund's exposure to foreclosure and other losses may be increased due to the illiquidity of its investments.

In addition, the Fund may need to refinance its outstanding debt as it matures. There is a risk that the Fund may not be able to refinance existing debt or that the terms of any refinancing may not be as favourable as the terms of the existing loan agreements. If prevailing interest rates or other factors at the time of refinancing result in higher interest rates upon refinancing, then the interest expense relating to that refinanced indebtedness would increase. These risks could adversely affect the Fund's financial condition, cash flows and the return on its investments.

No Operating or Investment History. The Fund has only recently commenced operations and therefore has limited operating history upon which prospective investors may evaluate its performance.

Complex Tax and Regulatory Risks. Legal, tax and regulatory changes (including changing enforcement priorities, changing interpretations of legal and regulatory precedents or varying applications of laws and regulations to particular facts and circumstances) could occur during the term of a Fund that may adversely affect any of such Fund or its investors.

Currency Risks. A significant portion of the Fund's investments (and the income and gains received by the Fund in respect of such investments) may be denominated in currencies other than the Euro. However, the books of the Fund will be maintained, and contributions to and distributions from the Fund will generally be made, in Euros. Accordingly, changes in foreign currency exchange rates, costs of conversion and exchange controls may materially adversely affect the value of the investments and the other assets of the Fund.

No Assurance of Investment Return. Carlyle cannot provide assurance that it will be able to successfully implement the Fund’s investment strategy, or that portfolio investments will generate expected returns. Moreover, Carlyle cannot provide assurance that any shareholder will receive a return of their capital or any distribution from the Fund. No organized secondary market is expected to develop for the shares of the Fund, and liquidity for the shares is expected to be provided only through quarterly redemptions of the Shares at NAV per share. Past performance of investment entities associated with Carlyle or its investment professionals is not necessarily indicative of future results or performance, and there can be no assurance that the Fund will achieve comparable results. Accordingly, investors should draw no conclusions from the performance of any other investments of Carlyle, and they should not expect to achieve similar results. An investment in the Fund involves a risk of partial or total loss of capital and should only be considered by potential investors with high tolerance for risk. The portfolio investments will be subject to the risks incidental to the operation of a credit strategy, including risks associated with the general economic climate, geographic or market concentration, the ability of the Fund to manage the portfolio investment, government regulations and fluctuations in interest rates. Since credit investments, like many other types of long-term investments, have historically experienced significant fluctuations and cycles in value, specific market conditions may result in occasional or permanent reductions in the value of the portfolio investments. This communication may not be distributed in whole or in part to any natural or corporate person without express written consent.

Valuations. The fair value of all investments or of property received in exchange for any investments will be determined by the AIFM in accordance with the Articles of Association and the Prospectus. For purposes of this website, the valuation of our investments is determined in accordance with the terms of ASC 820, Fair Value Measurement. Generally, Carlyle values its investments at their market price if market quotations are readily available, with a discount in the case of restricted securities. In the absence observable market prices, valuations may incorporate management's own assumptions and involve a significant degree of judgment, taking into consideration a combination of internal and external factors, including the appropriate risk adjustments for non-performance and liquidity risks. Investments for which market prices are not observable include private investments in the equity of operating companies, real estate properties, certain debt positions or CLOs. Valuations of non-EUR denominated unrealized investments are calculated in the applicable local currency and converted to Euros as of the relevant valuation date and accordingly, include the effects, if any, in movements in currency exchange rates.

References to portfolio companies are provided solely to illustrate the application of Carlyle's investment process, and are not and should not be considered a recommendation of any particular security or portfolio company. To ensure compliance with Internal Revenue Circular 230, you are hereby notified that any discussion of tax matters set forth in this website was written in connection with the promotion or marketing of the transactions or matters addressed herein and was not intended or written to be used, and cannot be used by any prospective investor, for the purpose of avoiding tax-related penalties under federal, state or local tax law. Prospective investors will be given the opportunity to ask questions and are encouraged to contact Carlyle to discuss the procedures and methodologies used to calculate the investment returns, as well as any terms and conditions of any Fund offering.

ESG: While Carlyle may consider environmental, social or governance ("ESG") factors when making an investment decision, prospective investors should note that the Fund does not pursue sustainable investment as its objective or limit its investments to those that meet specific ESG criteria or standards. Any reference herein to environmental or social considerations is not intended to qualify our duty to maximize risk-adjusted returns. Additionally, terms such as "ESG," "impact" and "sustainability" can be subjective in nature, and there is no representation or guarantee that these terms, as used by Carlyle, or judgment exercised by Carlyle or its affiliates or advisors in the application of these terms, will reflect the beliefs or values, policies, principles, frameworks or preferred practices of any particular investor or other third-party or reflect market trends.

The ESG or impact goals, commitments, incentives and initiatives outlined on this website are purely voluntary, are not binding on investment decisions and/or Carlyle's management of investments unless specified in the Prospectus and do not constitute a guarantee, promise or commitment regarding actual or potential positive impacts or outcomes associated with investments made by the Fund. Carlyle has established, and may in the future establish, certain ESG or impact goals, commitments, incentives and initiatives, including but not limited to those relating to diversity, equity and inclusion and greenhouse gas emissions reductions. Any ESG or impact goals, commitments, incentives or initiatives referenced in any information, reporting or disclosures published by Carlyle and do not bind any investment decisions made in respect of, or stewardship of, any funds managed by Carlyle for the purposes of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector, unless otherwise specified. Any measures implemented in respect of such ESG or impact goals, commitments, incentives or initiatives may not be immediately applicable to the investments of the Fund and any implementation can be overridden or ignored at the sole discretion of Carlyle. There can be no assurance that Carlyle's ESG policies and procedures as described herein, including policies and procedures related to responsible investment or the application of ESG-related criteria or reviews to the investment process will continue; such policies and procedures could change, even materially, or may not be applied to a particular investment.

The Fund is classified under Regulation (EU) 2019/2088 as an Article 8 fund for disclosure purposes. This classification is subject to change in light of any changes to the Fund's investment strategy, policies or otherwise, or as a result of broader changes to regulation, guidance or industry approach of any relevant jurisdiction. In light of this potential for change, investors should not base their decision to invest on the basis of the Fund's classification.

The Fund is distributed by Carlyle Global Credit Investment Management L.L.C.

NOTICES TO INVESTORS IN CERTAIN JURISDICTIONS

Notice To All Prospective Investors

Neither marketing material on this website nor any copy of it may be taken or transmitted into any country where the distribution or dissemination is prohibited. The marketing material on this website is being furnished to you on a confidential basis and solely for your information and may not be reproduced, disclosed, or distributed to any other person. The information, tools and materials represented in the marketing material on this website are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or any other financial instruments. Carlyle has not taken any steps to ensure that the securities referred to in marketing material on this website are suitable for any particular investor and will not treat recipients as its customers by virtue of their receiving the marketing material on this website.

Abu Dhabi Global Markets

The marketing material on this website is distributed to prospective investors by Carlyle MENA Advisors Limited which is duly licensed and regulated by the ADGM Financial Services Regulatory Authority (the "FSRA"). The marketing material on this website and related financial products or services are intended only for "Professional Clients" as defined under the FSRA rules and must not, therefore, be delivered to, or relied on by any other type of person.

The marketing material on this website and associated materials are provided to prospective investors for their exclusive use. The marketing material on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution would be unlawful under the applicable laws of such jurisdiction. Any distribution, by whatever means, of the marketing material on this website and related material to persons other than those referred to above is strictly prohibited. The FSRA accepts no responsibility for reviewing or verifying any Prospectus or other documents, including the marketing material on this website, in connection with this Fund. The Shares are illiquid and subject to significant restrictions on their resale. Prospective investors should conduct their own due diligence on the Shares. If prospective investors do not understand the contents of the website, prospective investors should consult an authorized financial advisor. This offer is not directed to Retail Clients.

Bahrain

The marketing material on this website regards the offer of financial instruments under the Prospectus in an overseas domiciled exempt collective investment undertaking for the purposes of Volume 7 of the Rulebook published by the Central Bank of Bahrain. It is a private placement. Accordingly, it is not subject to the rules of the Central Bank of Bahrain that apply to the offering of financial instruments in collective investment undertakings to the public and the extensive disclosure requirements and other protections that these rules contain. The marketing material on this website is, therefore, intended only for "accredited investors" as defined in the applicable rules of the Central Bank of Bahrain. The financial instruments offered in overseas domiciled exempt collective investment undertakings may only be offered by way of private placement and may only be offered in minimum initial subscriptions of US$100,000 (or equivalent in other currencies). The Central Bank of Bahrain assumes no responsibility for the accuracy and completeness of the statements and information contained in this website and expressly disclaims any liability whatsoever for any loss howsoever arising from reliance upon the whole or any part of the contents of the marketing material on this website.

Brazil

This offering is not a public offering of securities for the purposes of the applicable Brazilian regulations and has therefore not been and will not be registered with the Brazilian securities commission (Comissão de Valores Mobiliários) or any other government authority in Brazil. Documents relating to the securities, as well as the information contained therein, may not be supplied to the public in Brazil, as the offering of securities is not a public offering of securities in Brazil, nor used in connection with any offer for subscription or sale of securities to the public in Brazil. All information contained herein is confidential and is for the exclusive use and review of the intended addressee of this website and may not be passed on to any third party.

British Virgin Islands

No securities are being, and may not be, offered to the public or to any person in the British Virgin Islands ("BVI") for purchase or subscription by or on behalf of the Fund. The Shares may be offered to companies incorporated or re-registered under the BVI Business Companies Act, 2004 (as amended) and limited partnerships formed or registered under the Partnerships Act, 1994 (as amended) and/or the Limited Partnership Act, 2017 (as amended) or to natural BVI persons, but only where the offer will be made to, and received by, the relevant BVI entity or person entirely outside of the BVI or is otherwise permitted by BVI law.

Cayman Islands

No securities are being, and may not be, offered to the public or to any person in the Cayman Islands for purchase or subscription by or on behalf of the Fund.

Dubai International Financial Centre

The Fund that this website pertains to is not subject to any form of regulation or approval by the Dubai Financial Services Authority ("DFSA"). The DFSA has no responsibility for reviewing or verifying any offering memorandum or other document in connection with the Fund. Accordingly, the DFSA has not approved this fund or its Prospectus or any other associated documents nor taken any steps to verify the information set out in the Prospectus and associated documents and has no responsibility for it.

Fund shares shall only be offered upon request to institutions and individuals who qualify as a "Professional Client" as defined in the DFSA Conduct of Business Rule 2.3.2 and shall not offered, sold or publicly promoted or advertised in the Dubai International Financial Centre (the "DIFC") other than in compliance with the applicable DIFC laws and DFSA rules and regulations governing the issue, offering and sale of shares in foreign domiciled funds.

Notice to residents of EEA Member States

Material on this website is a marketing communication and is not a contractually binding document. Please refer to the Prospectus of the Fund and do not base any final investment decision on this communication alone. The information contained on this website is aimed at professional clients within the meaning of Article 4.1(10) of MiFID II ("Professional Client"). This information does not constitute an offer of invitation to invest and no person resident in the EEA other than a Professional Client should act or rely on this information. This information is not intended for retail clients, or any other individual (retail investor) or legal entity other than to professional clients within the meaning of MiFID II.

In relation to each member state of the EEA (each a "Member State") which has implemented the alternative investment fund managers directive (Directive (2011/61/EU)) ("AIFMD") (and for which transitional arrangements are not available), the marketing material on this website may only be distributed and Shares in the Fund may only be offered or placed in a Member State to the extent that: (1) the Fund is permitted to be marketed to professional investors in the relevant Member State in accordance with the AIFMD (as implemented into the local law/regulation of the relevant Member State); or (2) the marketing material on this website may otherwise be lawfully distributed and the Shares may otherwise be lawfully offered or placed in that Member State (including at the exclusive initiative of the investor).

Marketing of the Fund’s shares to retail investors within the meaning of Directive 2014/65/EU of 15 May 2014 on markets and financial instruments and Regulation (EU) No 600/2014 of May, 15 2014 on markets and financial instruments (“Retail Investors”) must be made in accordance with the requirements of Regulation (EU) 2015/760 of the European Parliament and of the Council of 29 April 2015 on European long-term investment funds, as amended by the Regulation (EU) 2023/606, (the “ELTIF Regulation”). In particular, an assessment of suitability will be carried out with respect to Retail Investors in accordance with Article 25 (2) of MiFID II and a statement on suitability will be communicated to Retail Investors in accordance with Article 25 (6), paragraphs 2 and 3 of MiFID II. The explicit consent of the Retail Investors indicating they understand the risks of investing in the Fund shall be obtained where all following conditions are met:

(a) the assessment of suitability is not provided in the context of investment advice;

(b) the Fund is considered not suitable on the basis of the assessment conducted under paragraph (a) above; and

(c) the Retail Investor wishes to proceed with the transaction despite the fact that the relevant Fund is considered not suitable for such investor.

Furthermore, in accordance with the ELTIF Regulation, as the Fund qualifies as an ELTIF and is marketed to Retail Investors, facilities will be made available for making subscriptions, making payments to shareholders, repurchasing or redeeming Shares and for making available the information the relevant Sub-Fund and the AIFM are required to provide under the ELTIF Regulation.

In particular, appropriate procedures and arrangements for dealing with complaints submitted by Retail Investors in one of the official languages of the Retail Investors' country shall be established.

For the avoidance of doubt, marketing to retail clients may take place, but only where this is permitted under applicable local law and to the extent that (where required) a PRIIPs KID has been made available to any Retail Investors.

Germany

The content of the marketing material on this website has not been verified by the German Federal Financial Supervisory Authority (Bundesanstalt Für Finanzdienstleistungsaufsicht, ("BAFIN")). The Shares may only be marketed or acquired within Germany in accordance with the German Capital Investment Act (Kapitalanlagegesetzbuch, ("KAGB")) and any laws and regulations applicable in Germany governing the issue, offering, marketing and sale of the Shares.

As the Fund qualifies as an ELTIF in accordance with the requirements of the ELTIF Regulation, the Shares may be marketed in Germany, directly or indirectly, to German private investors as defined in the KAGB. Prospective German investors are strongly advised to consider possible tax consequences of an investment in the fund and should consult their own tax advisors in that respect.

Notwithstanding the references to any compartment or fund vehicle other than Carlyle European Tactical Private Credit ELTIF or any interest in any such compartment or vehicle other than Carlyle European Tactical Private Credit ELTIF in this website, no interest other than the Shares are being offered hereby to prospective German investors. To the extent that this website provides information on compartments or fund vehicles other than Carlyle European Tactical Private Credit ELTIF, such information is for investor disclosure purposes only. The interests in any such compartment or other fund vehicle must not be marketed in Germany within the meaning of § 293 para. 1 KAGB.

Guernsey

The marketing material on this website may only be made available in or from within the Bailiwick of Guernsey, and any offer or sale of Shares may only be made in or from within the Bailiwick of Guernsey, either: (i) by persons licensed to do so under the Protection of Investors (Bailiwick of Guernsey) Law, 2020, as amended (the "POI Law"); or (ii) to persons licensed under the POI Law, or persons licensed under the Insurance Business (Bailiwick of Guernsey) Law, 2002, as amended, the Banking Supervision (Bailiwick of Guernsey) Law, 2020, as amended, the Insurance Managers and Intermediaries (Bailiwick of Guernsey) Law, 2002, as amended, the Regulation of Fiduciaries, Administration Businesses and Company Directors, etc., (Bailiwick of Guernsey) Law, 2020, as amended or the Lending, Credit and Finance Law, 2022 (as amended) by non-Guernsey bodies provided the Fund complies with the applicable requirements of the POI Law and all applicable guidance notes issued by the Guernsey Financial Services Commission.

The marketing material on this website and any offer or sale of Shares in the Fund pursuant to this website are not available in or from within the Bailiwick of Guernsey other than in accordance with the above paragraphs (i) and (ii) and must not be relied upon by any person unless received or made in accordance with such paragraphs.

Neither the Guernsey Financial Services Commission nor the States of Guernsey take any responsibility for the Fund or for the correctness of any of the statements made or opinions expressed with regard to it. If you are in any doubt about the contents of this website you should consult your accountant, legal or professional adviser, or financial adviser.

Hong Kong

The contents of the marketing material on this website have not been reviewed or approved by any regulatory authority in Hong Kong. Marketing materials on the website do not constitute an offer or invitation to the public in Hong Kong to acquire Shares. Accordingly, unless permitted by the securities laws of Hong Kong, no person may issue or have in its possession for the purposes of issue, marketing material on this website or any advertisement, invitation or document relating to Shares in the Fund, whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong other than in relation to Shares in the Fund which are intended to be disposed of only to persons outside Hong Kong or only to "professional investors" (as such term is defined in the securities and futures ordinance of Hong Kong (cap. 571) (the "SFO") and the subsidiary legislation made thereunder) or in circumstances which do not result in the marketing material on this website being a “Prospectus” as defined in the Companies Ordinances of Hong Kong (cap. 32) (the “CO”) or which do not constitute an offer or an invitation to the public for the purposes of the SFO or the CO. The offer of Shares in the Fund is personal to the person to whom this website has been delivered by or on behalf of the Fund, and a subscription for Shares in the Fund will only be accepted from such person. No person to whom a copy of this website is issued may issue, circulate or distribute this website in Hong Kong or make or give a copy of this website to any other person. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this website, you should obtain independent professional advice.

Isle of Man

The Fund is not subject to any form of regulation or approval in the Isle of Man. The marketing material on this website has not been registered or approved for distribution in the Isle of Man and may only be distributed in or into the Isle of Man by a person permitted under Isle of Man law to do so and in accordance with the Isle of Man Collective Investment Schemes Act 2008 and regulations made thereunder. The participants in the Fund are not protected by any statutory compensation scheme.

Israel

The Shares in the Fund described in this website have not been registered or approved for offering and are not expected to be registered under the Israeli Securities Law — 1968 (the ''Securities Law'') or under the Israeli Joint Investment Trust Law – 1994 ("Joint Investment Law"). Accordingly, the Shares in the Fund described herein will only be offered and sold in Israel pursuant to applicable private placement exemptions, (i) to Qualified Investors described in Section 15A(b)(1) of the Securities Law and the First Schedule of the Securities Law ("Qualified Israeli Investors") and to 35 or fewer offerees that are non-Qualified Israeli Investors during a consecutive 12-month period, as permitted under the applicable exemptions of the Securities Law; and (ii) shall include at any given time an unlimited number of Qualified Israeli Investors, and up to additional 50 participants that are not Qualified Israeli Investors, as permitted under the applicable exemptions of the Joint Investment Law.

The Fund is not a licensed investment marketer under the Law for the Regulation of Provision of Investment Advice, Marketing Investments and Portfolio Management – 1995 (the "Investment Advisor Law") and the Fund does not maintain insurance as required under such law. Accordingly, the Shares in the Fund described herein will only be offered and sold in Israel to parties which qualify as a "Qualified Client" for purposes of section 3(a)(11) and first schedule of the Investment Advisor Law.

If any recipient in Israel of a copy of marketing material on this website is not qualified as such, such recipient should promptly return the marketing material to the Fund.

Italy

The marketing material on this website is addressed to professional investors as defined in the Italian Consolidated Law on Finance no. 58 of February 24, 1998, as amended from time to time (the "FCA") and in the regulations of the commissione nazionale per le società e la borsa ("CONSOB") issued pursuant to it, in accordance with the framework of Directive 2014/65/EU of 15 May, 2014 on Markets and Financial Instruments and Regulation (EU) No 600/2014 of 15 May, 2014 on Markets and Financial Instruments.

As the Fund qualifies as an ELTIF, the Shares may be marketed to Retail Investors accordance with the requirements of the ELTIF Regulation.

The addressee acknowledges and confirms the above and hereby agrees not to circulate the marketing material on this website in Italy unless expressly permitted by, and in compliance with, applicable law.

In addition, any investor will be required to agree and represent that any on-sale or offer of any Share by such investor (in accordance with the Fund’s documents) shall be made in compliance with all applicable laws and regulations.

Jersey

Consent under the control of Borrowing (Jersey) Order 1958 has not been obtained for the circulation of the marketing material on this website. Accordingly, the offer that is the subject of the marketing material on this website may only be made in Jersey where the offer is not an offer to the public or the offer is valid in the United Kingdom or Guernsey and is circulated in Jersey only to persons similar to those to whom, and in a manner similar to that in which, it is for the time being circulated in the United Kingdom or Guernsey as the case may be. By accepting this offer each prospective investor in Jersey represents and warrants that he or she is in possession of sufficient information to be able to make a reasonable evaluation of the offer.

Jordan

This Fund has not been and will not be filed, approved, or registered with the Jordan Securities Commission in accordance with its regulations and any other legislations in the Hashemite Kingdom of Jordan. This Fund has not been and will not be offered or sold, at any time, directly or indirectly, in the Hashemite Kingdom of Jordan, unless in compliance with the provisions of the Securities Law No. 18 of 2017 and the regulations and instructions issued pursuant thereto.

Kuwait

The marketing material on this website is not for general circulation to the public or privately in Kuwait. Shares in the Fund have not been licensed for offering in Kuwait by the Capital Markets Authority, the Kuwait Central Bank or any other relevant Kuwaiti governmental agency. Unless all necessary approvals from the Kuwait Capital Markets Authority pursuant to Law No. 7/2010 and the implementing regulations thereto (as amended), and the various resolutions, instructions and announcements issued pursuant thereto, or in connection therewith, have been given in relation to the marketing of, and sale of, the Shares, the Shares may not be offered for sale, nor sold, in Kuwait.

The offering of Shares in the Fund in Kuwait on the basis of a private placement or public offering is, therefore, restricted. No private or public offering of Shares in the Fund is being made in Kuwait, and no agreement relating to the sale of Shares in the Fund will be concluded in Kuwait. No marketing or solicitation or inducement activities are being used to offer or market Shares in the Fund in Kuwait.

Monaco

Shares in the Fund may not be offered or sold, directly or indirectly, to investors in Monaco other than by a duly authorized intermediary or otherwise than as permitted under Monaco law. Such intermediaries being banks and financial activities companies duly licensed by the “Commission de Contrôle des Activités Financières” (CCAF).

In addition, the Shares in the Fund may be offered or sold to: i) institutional investors (e.g. pension funds, the government, the sovereign fund, the Prince’s Foundation, banks, CCAF licensed entities and insurance companies); ii) investors who have raised enquiries of their own initiative (on a cross border and reverse solicitation basis); and iii) existing clients of CCAF licensed entities acting as an intermediary (or in a similar capacity) or existing clients of Carlyle Group entities (on a cross-border basis). The distribution of this website is restricted accordingly.

By accepting the marketing material on this website, recipients warrant that they are fluent in English and expressly waive the possibility of a French translation of this document. Les destinataires du présent document reconnaissent être à même d’en prendre connaissance en langue anglaise et renoncent expressément à une traduction française.

Oman

The marketing material on this website neither constitutes a public offer of securities in the Sultanate of Oman as contemplated by the Commercial Companies Law of Oman (Royal Decree 4/74) or the Capital Market Law of Oman (Royal Decree 80/98), nor does it constitute an offer to sell, or the solicitation of any offer to buy non-Omani securities in the Sultanate of Oman as contemplated by Article 139 of the Executive Regulations to the Capital Market Law (issued vide CMA Decision 1/2009). Additionally, the marketing material on this website is not intended to lead to the conclusion of any contract of whatsoever nature within the territory of the Sultanate of Oman.

Any investor from Oman, which receives the marketing material on this website, acknowledges that it has been provided the same on the basis of the investor's:

A. request;

B. confirmation that this information will be kept strictly private and confidential; and

C. representation that he/she is a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and has such experience in business and financial matters that he/she is capable of evaluating the merits and risks of an investment in securities. The investor acknowledges that an investment in securities is speculative and involves a high degree of risk.

The marketing material on this website, and the Shares to which it relates, may not be advertised, marketed, distributed or otherwise made available to the general public in Oman. In connection with the offering of the Shares, no marketing material on this website has been registered with or approved by the Central Bank of Oman, the Oman Ministry of Commerce and Industry, the Oman Capital Market Authority or any other regulatory body in the Sultanate of Oman. The offering and sale of Shares described in the marketing material on this website will not take place inside Oman. Shares are being offered on a limited private basis, and do not constitute marketing, offering or sales to the general public in Oman. Therefore, the marketing material on this website is strictly private and confidential, and is being issued to a limited number of sophisticated investors, and may neither be reproduced, used for any other purpose, nor provided to any other person than the intended recipient hereof.

Qatar

The Shares described in the marketing material on this website have not been offered, sold or delivered, and will not be offered, sold or delivered at any time, directly or indirectly, in the State of Qatar in a manner that would constitute a public offering. The marketing material on this website has not been reviewed or registered with the Qatari Central Bank or any other Qatari government authorities and does not constitute a public offer of securities in the State of Qatar under Qatari law. Therefore, the marketing material on this website is strictly private and confidential, and is being issued to a limited number of sophisticated investors, and may neither be reproduced, used for any other purpose, nor provided to any person other than the intended recipient hereof.

Saudi Arabia

The marketing material on this website may not be distributed in the Kingdom of Saudi Arabia except to such persons as are permitted under the offers of Securities Regulations issued by the Capital Market Authority.

The Capital Market Authority does not make any representation as to the accuracy or completeness of the marketing material on this website, and expressly disclaims any liability whatsoever for any loss arising from, or incurred in reliance upon, any part of this website. Prospective purchasers of the Shares offered hereby should conduct their own due diligence on the accuracy of the information relating to the securities. If you do not understand the contents of this website you should consult an authorized financial advisor.

Singapore

The marketing material on this website and any other material in connection with the offer or sale is not a prospectus as defined in the Securities and Futures Act 2001 of Singapore (the "SFA"). Accordingly, statutory liability under the SFA in relation to the content of this Factsheet would not apply. You should consider carefully whether the investment is suitable for you.

The marketing material on this website has not been and will not be registered as a Prospectus with the Monetary Authority of Singapore (the "MAS") and this offering is not regulated by any financial supervisory authority pursuant to any legislation in Singapore. The Fund is not authorized or recognized by the MAS and Shares are not allowed to be offered to the retail public. Accordingly, the marketing material on this website and any other document or material in connection with the offer or sale, or invitation for subscription or purchase of the Shares may not be circulated or distributed, nor may the Shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor under section 4A of the SFA; (ii) to a relevant person under section 305(1) of the SFA; (iii) to any person pursuant to an offer referred to in section 305(2) of the SFA; or (iv) otherwise pursuant to, and in accordance with the conditions of any other applicable provision of the SFA.

Switzerland

The marketing material on this website does not constitute a prospectus pursuant to the Collective Investment Schemes Act dated 23 June 2006 as amended (the "CISA") or the Financial Services Act dated 15 June 2018 as amended (the " FinSA") and may not comply with the information standards required thereunder. The Shares in the Fund will not be listed on the SIX Swiss Exchange or another Swiss Exchange and consequently the marketing material on this website does not necessarily comply with the standards set out in the relevant listing rules. The documentation of the Fund has not been approved by the Swiss Financial Market Supervisory Authority ("FINMA") for distribution to non-qualified investors. The Fund only can be offered to Institutional and Professional Investors within the meaning of Art. 4 (3)-(5) FINSA, as well as HNWI, private investment structures created for them with opting-out as defined in Article 5 Paragraph 1 FinSA and Retail Investors within the meaning of Art. 103ter CISA (Qualified Investors). Investors do not benefit from supervision by FINMA. An investment in the Fund is therefore only available to, and any advertising is only directed at, institutional and professional clients according to FinSA and Retail Investors within the meaning of Art. 103ter CISA. Therefore, an investment in the Fund may carry higher levels of risk. The marketing material on this website may only be used by those persons to whom it has been delivered in connection with the shares of the Fund and may neither be copied, directly/indirectly distributed, nor made available to other persons. The marketing material on this website does not constitute investment advice.

The Representative in Switzerland is: Société Générale Paris, Zürich Branch, Talacker 50, P.O. Box 5070, CH-8021 Zürich, Switzerland.

The Paying Agent in Switzerland is: Société Générale Paris, Zürich Branch , Talacker 50, P.O. Box 5070, CH-8021 Zürich, Switzerland.

United Arab Emirates

The offering of the Shares has not been approved or licensed by the UAE Central Bank, the UAE Securities and Commodities Authority ("SCA"), the Dubai Financial Services Authority ("DFSA"), the Financial Services Regulatory Authority ("FSRA") or any other relevant licensing authorities in the UAE, and accordingly does not constitute a public offer of securities in the UAE in accordance with the Commercial Companies Law, Federal Law No. 32 of 2021, the SCA’s Financial Activities Rulebook and mechanisms of adjustment or otherwise. Accordingly, the Shares may not be offered to the public in the UAE (including the Dubai International Financial Centre ("DIFC") and the Abu Dhabi Global Market ("ADGM")). The marketing material on this website is strictly private and confidential and is being issued to a limited number of investors:

A. who fall within the exceptions To The SCA’s Financial Activities Rulebook and mechanisms of adjustment;

B. upon their request and confirmation that they understand that the Fund has not been approved or licensed by or registered with the UAE Central Bank, the SCA, DFSA, FSRA or any other relevant licensing authorities or governmental agencies in the UAE; and

C. to the named addressee only, who has specifically requested it, and should not be given or shown to any other person (other than employees, agents or consultants in connection with the addressee’s consideration thereof), and must not be provided to any person other than the original recipient, and may not be reproduced or used for any other purpose.

United Kingdom

The Fund is an unregulated collective investment scheme as defined in the Financial Services and Markets Act 2000 of the United Kingdom ("FSMA 2000"). The Fund has not been authorized, or otherwise recognized or approved by the UK Financial Conduct Authority ("FCA") and, as an unregulated scheme, it accordingly cannot be promoted in the United Kingdom ("UK") to the general public. In the UK, the contents of marketing material on this website have not been approved by an authorized person within the meaning of section 21 of FSMA 2000. Approval is required unless an exemption applies under section 21 of FSMA 2000. Reliance on marketing material on this website for the purpose of engaging in any investment activity may expose an individual to a significant risk of losing all the property or other assets invested. The marketing material on this website will only be communicated to persons to whom a financial promotion can be made lawfully by an unauthorized person (without prior approval of an authorized person) pursuant to the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) (the "FPO") and then, if made by an authorized person, only where it can also be made under the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemptions) Order 2001 (as amended) (the "PCISO"). It will therefore only be communicated to:

a) persons believed on reasonable grounds to fall within one of the categories of "investment professionals" as defined in Article 19(5) of the FPO and Article 14 PCISO;

b) persons believed on reasonable grounds to be "high net worth companies, unincorporated associations etc" within the meaning of Article 49 of the FPO and Article 22 PCISO: and

c) persons to whom this website may otherwise lawfully be provided in accordance with FSMA 2000 and the FPO (as amended).

Any person who is in any doubt about the investment to which the marketing material on this website relates should consult an authorized person specialized in advising on investments of the kind in question. Transmission of the marketing material on this website to any other person in the UK is unauthorized and may contravene FSMA 2000. Carlyle Global Credit Investment Management LLC ("CGCIM") will manage the global distribution of this offering in accordance with the terms of the amended and restated placement agreement between CIM Europe, S.à r.l. (the "AIFM") and CGCIM in respect of the Fund (registered name: Carlyle Private Markets S.A. SICAV-UCI Part II; incorporated in Luxembourg; RCS number: B274623; registered office: 9, rue de Bitbourg, L-1273, Luxembourg, Grand Duchy of Luxembourg).